A Nium Partnership

For over a decade, Nium has invested in building its payment platform with deep banking relationships and highly focused technology. Nium enables its clients to pay into over 190 countries, through over 110 currencies, using a broad set of payment methods—many of which are real-time. The company moves money at the rate of USD 50 billion annually, while providing compliance checks such as KYB and KYC.

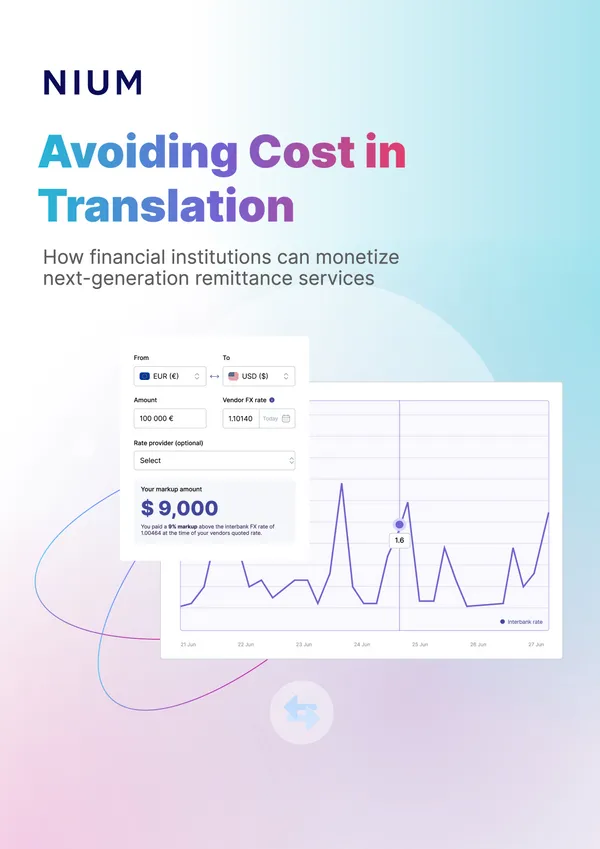

But it’s not just a passive approach to payments. Nium examines its transaction data and, with machine learning, constantly optimizes for the best routes that address cost, speed, and reliability requirements. When combined with Nium’s transparent fee structures, our partners gain a level of clarity and predictability other processors can’t provide. It allows organizations to use payments as a strategic enabler and a monetization opportunity.

For the business case around remittance, partnering with Nium ensures banks reach even the farthest outlying regions reliably, cost-effectively, and at scale.

Avoiding Cost in Translation

Nium Dev Team

Avoiding Cost in Translation

The keys to a successful remittance offering:

- Identifying a fintech partner to support remittance paths

- Decide on core value positioning and messaging for service

- Create go-to-market plan to drive customer awareness

- Integrate partner technology with existing services

New document

Bookmark

1 of 345

Settings

Profile