Manage, Control and Optimize Spending on a Global Scale

Automate global expense and reimbursement processes with real-time payments and virtual cards for a seamless, borderless experience.

Spend management

Efficient Spend Management

for a Connected World

With business now global by default, spend management is becoming increasingly complex and time-consuming, with travel, cross-border suppliers and employees anywhere.

Nium helps businesses and spend management platforms eliminate inefficiencies and reduce costs through real-time global payments, multi-currency wallets and card solutions. With enhanced visibility and control over expenses, including predictable costs and streamlined operations, businesses can confidently control spending at scale.

Streamlined Global Payments and Expense Management

-

Eliminate intermediary bank fees

Say goodbye to fees charged by intermediary banks with access to real-time global payment rails.

-

Open global wallet accounts instantly

Empower your customers to store and deploy funds in every region they operate in for global operations, efficient payment timelines and reconciliation.

-

Optimize money management

Fund local currency accounts in 30 countries, navigate compliance complexity, and payout to 190+ countries, including 100 with real-time payments.

-

Route payments for acceptance and value

Optimize payment routes for speed and cost, with end-to-end visibility through Nium’s Payment Chronometer, powered by machine learning and updated transaction data.

Full FX Control

-

Control rates and fees at source

Access real-time interbank rates for guaranteed cost predictability, with full visibility over fees and markups.

-

Lock and hold rates

Lock FX rates for up to 24 hours and choose to convert funds in real time using pre-funded balances or on a future scheduled date.

-

Expand coverage and currency pairs

Manage payments in 100+ currencies optimized through over 2,000 currency pairs, including emerging market currencies.

End-to-End Spend Life Cycle Control

-

Automate manual expense management

Save time for finance and accounting teams with automated workflows for invoice management, payouts, and reconciliation.

-

Drill down on essential detail

Control cash flow and expenses with real-time payment and settlement insights, driving data-driven decision-making and financial visibility.

-

Streamline purchasing and reconciliation

Enable customers to digitize their expenses through virtual cards that improve on-time payments and automate reconciliation.

Built for Global Spending

-

Get to market faster

Accelerate the onboarding process and reduce time to market with virtual accounts and digital documentation, enabling clients to start remitting on your platform within minutes.

-

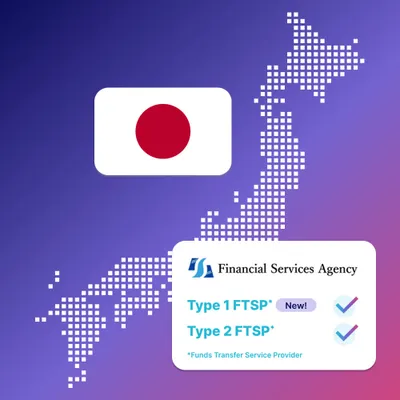

Integrate compliance and risk management

Implement robust eKYB and eKYC prescreening processes for compliance, fraud prevention, and accurate payment data verification to minimise risk and exposure while ensuring regulatory compliance.

-

Customize card issuance

Develop tailored virtual and physical card programs that align with your expense policies and specifications. Offer specific limits, rules, and merchant categories for enhanced control and flexibility.

Reliable Reimbursements

-

Pre-fund wallets on your terms

Ensure your multi-currency wallets are always adequately funded with automated bank transfers or direct debits, set to predefined funding thresholds.

-

Convert currency seamlessly

Accept and disburse funds in multiple currencies, minimizing conversion hassles and FX costs through the Nium wallet.

-

Ensure reliable vendor and supplier payouts

Guarantee reimbursements for suppliers and providers in their verified bank, wallet, or card accounts, in their local currency through compliant local rails.

Join 1000+ companies on the Nium payments infrastructure

Our Platforms & Enterprises customers include:

Products

The Global Infrastructure For Real-Time Payments

Nium moves money, manages foreign exchange and mitigates

fraud risk so your business can send and receive funds in real time.

Resources

Interested?

Ready To Accelerate Your Global Business Growth?

Connect with our experts to explore use cases based on your industry, discuss customized pricing, and answer any questions you have.