By: Dzmitry Mikhaliov, Director of Business Development, Nium Checkout

With India’s population reaching 1.4 billion and global forecasts unanimously predicting its rise as the world’s third-largest economy by 2023, surpassing Japan and Germany, global enterprises are increasingly interested in entering the Indian market.

This trend is particularly relevant for digital goods and services and travel providers, whose products transcend borders. Consumer SaaS, e-Learning, gaming, streaming, mobile apps, experiences booking platforms, and online travel agencies (OTAs) are all prime examples. As a business development professional, I frequently engage with founders and heads of payments, and it’s evident that considerations for expanding into India are becoming more commonplace.

Yet, as someone deeply entrenched in the cross-border payments domain and specifically the Indian peculiarities of it, I can confidently say that it is one of the most complex markets to enter as an international merchant, reserving an immense opportunity for those who manage to get it right.

Largely there are three major areas to consider upon entering the Indian market:

1. Uniqueness of the Payment Landscape

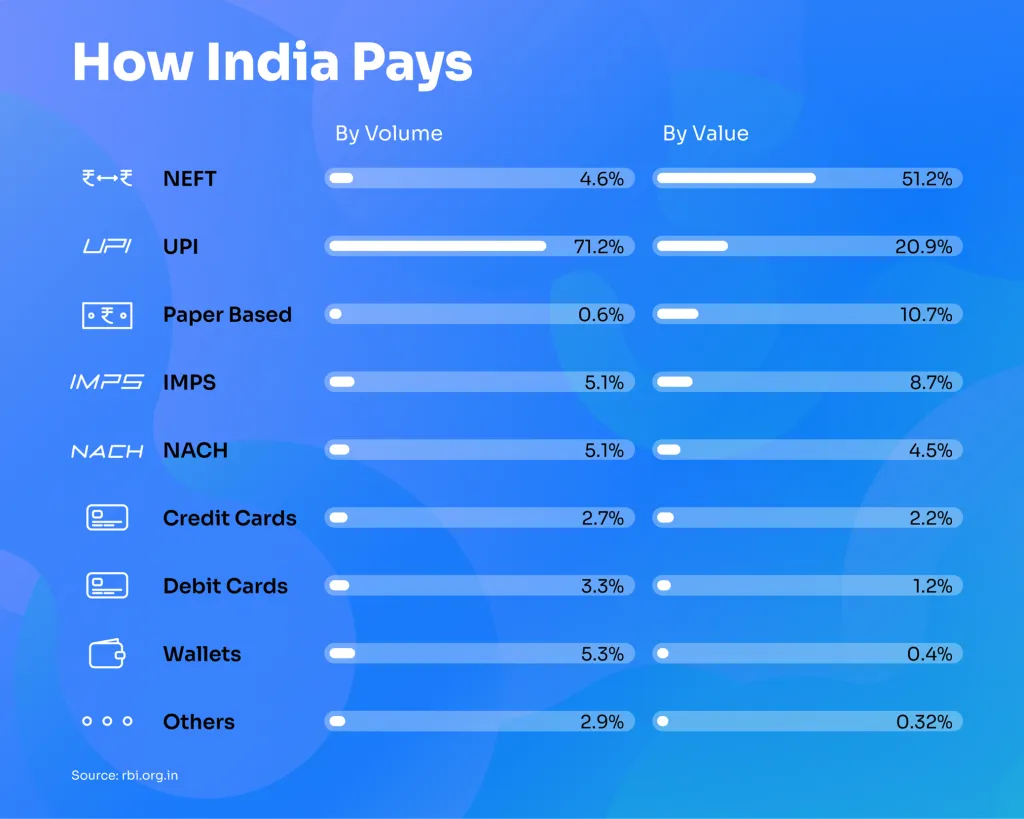

India is heavily reliant on domestic payment methods, with cards making up just 6% of the total payment volume in the market.

UPI has become a primary payment method in no time, taking up 72% market share in 2022 after its introduction six years ago. It keeps growing at double-digit numbers, posting a 74% YoY volume growth in January 2023.

This is why entering India with international acquiring only is simply not an option.

2. Specifics of the Regulatory Environment

India is unique when it comes to the local regulatory aspect as well. One regulatory requirement that applies to all international businesses–irrespective of the industry–is the need to access Indian local payment methods (such as UPI, Rupay, netbanking, etc.) on a cross-border basis, without the obligation of establishing local presence. Setting up a local operation in India requires substantial time and upfront investment. However, such cross-border setup can only be supported by a select few payment service providers, who possess special approval from the RBI to facilitate cross-border funds movement in consortium with an Authorized Dealer bank.

Furthermore, multiple other industry-specific requirements must be navigated based on the nature of the business. For instance, if you’re running a travel business, compliance with the Liberalized Remittance Scheme (LRS) is necessary. This entails verifying an individual’s PAN number to ensure that the annual limit of $250,000 for remittances has not been exceeded. Additionally, growing restrictions when dealing with gaming companies, especially with the recent ban on certain apps and stringent oversight in place for the gaming industry.

3. Taxation Challenges

Taxing cross-border e-commerce transactions has been a challenge for many jurisdictions worldwide, including India. These challenges arise due to factors such as determining the location of the supplier, the absence of any local presence, difficulties in specifying the nature of the transaction (e.g., as the sale of goods or services), administrative hurdles in enforcing and collecting taxes and issues in affirming tax jurisdiction.

India and several other countries worldwide have implemented measures like imposing digital services taxes (OIDAR) to address these issues. As a result, any overseas supplier involved in the provision of such services to an Indian customer is required to undergo a registration process under the Goods and Services Tax (GST) law and is required to follow routine monthly compliances. Another tax consideration to keep in mind for cross-border e-commerce in India is an Equalization Levy, which is aimed at taxing B2B cross-border transactions. When it comes to travel, deep expertise in Tax Collected at Source (TCS) regulations, which requires specialized knowledge and expertise.

Sounds complicated? It is. The solution? Working with a provider with a deep local expertise in India, specifically in cross-border payments, possessing essential licensing, and specialized industry expertise in Digital Goods and Travel. There is an increasing opportunity for app developers to go beyond in-app payments and supplement with a more holistic payment provider for India ,given the recent developments on the anti-competitive and high-cost service provided by the app stores. (link)

To learn more about our efforts at Nium Checkout to simplify the cross-border funds movement for India contact me by scheduling a meeting here.

About Dzmitry Mikhaliov

Based in Dubai, UAE, Dzmitry is the Director of Business Development for Nium Checkout. With a breadth of experience in financial technology and services on both the operating and investing side, he leads Nium Checkout’s go-to-market activities globally.

.png@webp)