Editor’s Note: In our last post from tech@Nium, Chief Architect, Ankit Gupta, introduced Nium Chronometer, a technology enabling more precise payment tracking and visibility. For Part 1, click here. In this post, Ankit illustrates different aspects of how payments are tracked using Chronometer.

Cross border payments are hard and unpredictable because of multiple markets, multiple clearing systems and SLAs, compliance and local regulations and different integration touch points and multiple hops. At Nium, we are determined to not accept this status quo and change cross border payments for good. Our philosophy on payments is that every cross border payment needs to adhere to four key RSTP (Reliability, Scalability, Traceability, Predictability) commandments.

.gif)

The First Commandment: 'R’eliability

Ensuring reliability is no easy task but we have got you covered. There are multiple things we do to ensure reliability for the payments we process namely:

Intelligent Routing

Nium has a next generation intelligent payment processing platform which has configurable routing rules to choose a partner integration basis the payment attributes and are optimized for high straight through processing rate and low cost. The platform automatically reroutes the partner through multiple available options in case the payment does not get delivered via one partner. If you want to delve more on how we make the magic happen, please refer our blog click here.

Proactive Alerting and Resolution

Nium has setup internal alerts and dashboards where if a payment goes into Error or breaches the expected clearing time, alerts are raised for internal operation teams to monitor. The intelligent routing manages rerouting basis the type of the error, but the alert dashboards provide a second layer of defence in case the transaction cannot be routed through any alternate partners or all available options have been exhausted. Proactive alerting means in case of issues with payment or partner immediate action can be taken and mean time to resolution is reduced from an operational perspective.

![]()

Returns Management

When a payment cannot be delivered which can be due to numerous reasons like Invalid or Frozen bank account etc, providing the exact reason code along with description is critical for the customer to know the reason why the payment was returned back. At Nium we have done over 60+ partner integrations and not all partners respond with reason codes in a consistent and standard format. We have mapped and standardized Nium APIs to return ISO 20022 reason codes which covers 75% of our returns today.

Confirmation of Payee

Our experience has been a large percentage of payment returns happen due to invalid beneficiary account number. Nium has built a confirmation of beneficiary API which pre-validates the beneficiary bank account before sending the transaction. This improves the overall customer experience and at the same time minimizes the overhead of returns. Approximately 75% of all transactions that fail are due to incorrect payee account number or inactive payee account status which will be resolved by using confirmation of payee upfront.

The Second Commandment: 'S’tability

Nium Payment processing platform processes $24B+ transaction volume in 100+ real-time markets across the globe. We have achieved this by adhering to below set of principles

-

Cloud native micro-services architecture built for scale.

-

Zero downtime deployments, Hystrix and Circuit breaking.

The Third Commandment: 'T’raceability

Payment Tracking

Need to track a payment in transit? No problem. We got you covered! Nium enables payment tracking via fetching payment status via APIs or webhook notifications that Nium sends whenever a payment status is updated. Nium has a comprehensive state transition engine which is used by both API, webhooks and the dashboards where the payment journey for all stages is displayed.

![]()

Proof of Payment

When a payment is delayed or in case of a dispute, the beneficiary needs to find out quickly where the funds are and understand the reason for the delay. A proof of payment becomes key in this case to investigate end to end and track a payment. Nium supports different proof of payments ranging from UETR, GPI and local banking clearing system transaction numbers.

The Final One: 'P’redictability

We know how money moves in 190+ markets along with the volume of transactions our platform processes, we have the data to predict the expected delivery time for a payment with high accuracy.

Predictive TAT (Turn Around Time)

We have combined the power of data to build a Machine learning model which can accurately predict the delivery TAT for a future payment by looking at the delivery TAT for a similar payment in the past. The Predictive TAT service that we have built uses models that have been trained on payment characteristics like delivery corridors, payment modes, partner banks and many more.

Nium’s mission is to build a seamless payment experience for our customers and Chronometer is the chronological x-ray into the payments lifecycle.

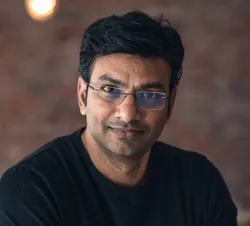

By Ankit Gupta and Ramana Satyavarapu

.png@webp)

.png@webp)