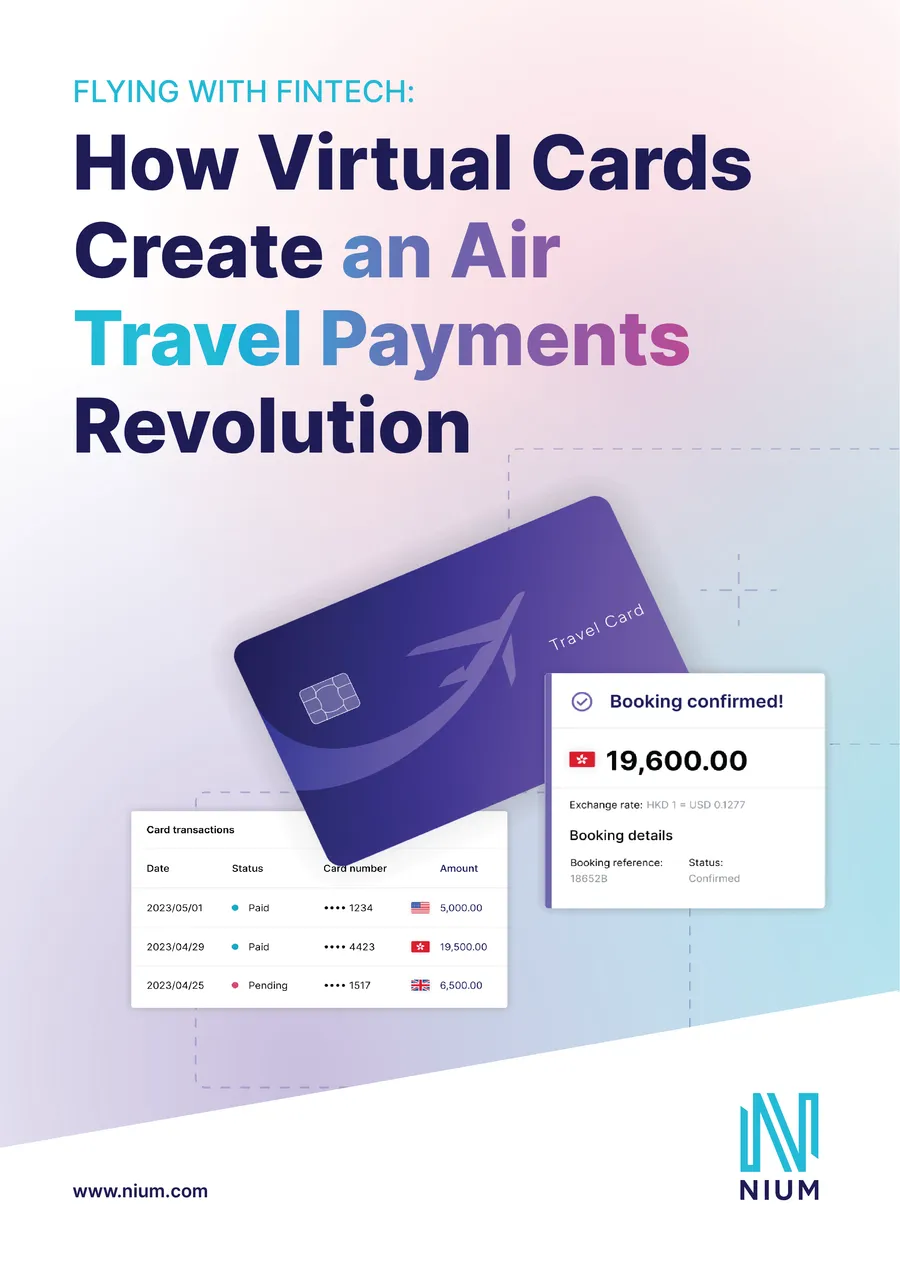

Worldwide OTA

Payments Powered by

Nium Virtual Cards

Deliver reliable, flexible payments on a global scale, with real-time capabilities for over 100 markets.

Online travel agencies

Connect Your Global Network With Payments You Can Trust

Slow, expensive, and high-risk payments are eating into ever shrinking OTA profit margins, while reconciliation and settlement delays create funding gaps that can slow down growth. Nium Virtual Cards provide OTAs with real-time, secure, and cost-effective payment options. Improve your financial operations, unlock new revenue streams, and enhance customer satisfaction with global reach to pay airlines, suppliers and hotels effectively.

Scalable, Efficient Global Payments

-

Manage cash flow In real time

Schedule Nium Virtual Card loads just in time for payments, optimizing cash flow and reducing the need for financial bonding.

-

Flatten FX

Minimize foreign exchange conversion costs with the ability to add money to your account and create virtual cards in 20+ issuing currencies.

-

Earn rewards

Generate new revenue streams from the payments you already make with Nium’s rewards program.

Reliable Control and Transparency

-

Maximize acceptance

Safeguard merchant acceptance and eliminate surcharges with full support from Nium, ensuring smooth transactions

-

Safeguard your payments

Minimize fraud exposure with single-use virtual cards and scheduled loads, enhancing transaction security.

-

Automate reconciliation

Attach and match booking references with a unique card for every booking, speeding up reconciliation processes and reducing administrative workload.

Configurable to Your Unique Needs

-

Adapt to every use case & territory

Tailor processes by partner and region with the ability to issue cards in 20+ currencies, accepted in 150+ countries and customize up to 20 data fields per transaction.

-

Backup issuing and processing

Protect your business from outages with backup issuing and processing capabilities, ensuring uninterrupted payments. In case of supplier disruptions or default, chargebacks recover your payments, providing additional security.

-

Protect your relationships

Reduce friction in working with airlines, hotels and suppliers with the ability to choose a closed-loop solution for air travel payment.

Join 1000+ companies on the Nium payments infrastructure

Our Travel customers include:

Products

The Global Infrastructure For Real-Time Payments

Nium moves money, manages foreign exchange and mitigates

fraud risk so your business can send and receive funds in real time.

Resources

Interested?

Ready To Accelerate Your Global Business Growth?

Connect with our experts to explore use cases based on your industry, discuss customized pricing, and answer any questions you have.