The rise of remote work has changed how companies operate. In 2022, global hiring increased by 145% as the pandemic taught us that we all didn’t need to be in the same building to effectively collaborate.

You can hire from anywhere for the best skills and value for the job at hand, whether that’s for permanent staff, contract workers, or freelance support. With a core team in the United States, you can mix in outsourced customer support in Mumbai, while bringing in ad-hoc developer talent from Lithuania to overhaul your website.

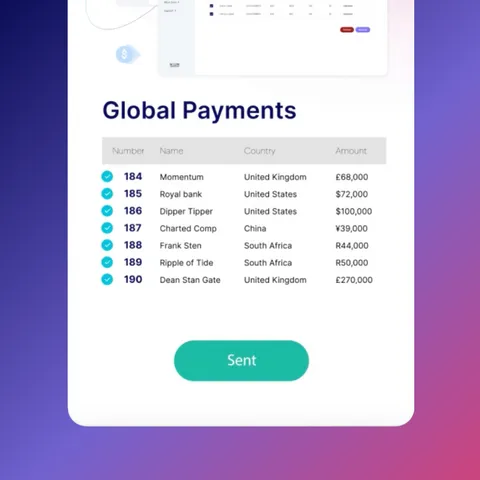

However, this push towards global expansion brings unique challenges in managing payroll across different countries. You must navigate various compliance regulations, deal with fluctuating currency exchange rates, and understand the myriad payment systems unique to each locale.

Suffice to say, getting global payroll right is essential to your global expansion ambitions. Your payment platform can play a huge role here, making the process simpler and more efficient, ensuring you can pay your employees in their currency, in a timely manner, no matter where in the world they are.

The global payroll landscape

To give you an idea of the extent of globalization, we’ll let the data do the talking:

- 68% of U.S. companies leverage international talent to enhance their competitiveness while maintaining cost efficiency.

- 36% of employers are willing to hire completely remote workers.

- The share of firms that expanded their hiring of international workers from 2020 to 2021 grew nearly six times, from 8% to 46%.

The flexibility to hire from across the globe, whether for permanent roles or on a project basis, is not just a trend but a strategic imperative that enables businesses to optimize budgets and harness diverse talents tailored to specific needs.

At the same time, more businesses are looking at new markets to power growth.

- 49% of U.S. companies said their best opportunities are outside of their home region.

- A poll of over 2,000 midmarket enterprises across 14 different markets found that two-thirds planned to expand internationally in the next 12 months.

This global reaching, however, brings to the forefront the complexity of managing multi-country payroll, highlighting a critical need for solutions that can navigate the intricate web of local compliance, taxation, and payment practices across diverse geographies.

The challenges of global payroll

To show the challenges of having a global workforce, let's use an example to illustrate the headaches. You are a US-based tech company that has recently outsourced the redevelopment and maintenance of your website to an agency in India. On paper, this move seems fantastic - access to skilled talent at a competitive rate. But when it comes to paying your Indian agency, complexities lurk around every corner.

One major hurdle is the dynamic currency exchange. The constant fluctuation between USD and INR can significantly impact your budget, potentially creating discrepancies and headaches. You'll need strategies to mitigate these fluctuations and ensure predictable payments for your partners. Traditional international wire transfers often come with hefty fees and delays, potentially impacting your agency's cash flow, and straining your relationship.

Finding faster, more cost-effective solutions becomes paramount. Finally, accepting limited payment options can be problematic. Some Indian agencies may not accept your preferred US methods, forcing you to navigate unfamiliar solutions with potentially high conversion fees and security risks.

This example shows the challenges typical of any global payroll situation. Smooth global payroll requires diverse payment options tailored to the local landscape. This is where innovative payment providers step in, offering solutions to navigate these currency and payment complexities, ensuring timely and secure transactions that foster trust and a successful partnership with your international partners.

Solving payroll challenges through payments

Taking advantage of the growth potential of global hiring requires payroll companies to solve three key challenges.

Managing FX at scale

The hurdle of managing foreign exchange (FX) efficiently is significant, with traditional methods often leading to excessive transaction costs and FX risks. At Nium, we offer scalable international payment models that minimize FX risks and transaction costs. Our technology enables real-time FX management, allowing companies to lock in the best rates for every transaction, thus making global payroll operations more predictable and streamlined.

Meeting service levels

The growing demand for real-time payments, crucial for both employee satisfaction and business transparency, is also met by Nium. Our solution caters to the need for security, convenience, and real-time oversight over payroll processes, thereby ensuring timely payments to a globally distributed workforce and maintaining trust and satisfaction across all levels.

Infrastructure

To navigate the challenges posed by traditional banking infrastructures, we have built a modern financial infrastructure tailored for the global economy. With features like multi-currency wallets and direct access to a global network, Nium significantly reduces the cost and complexity of international payments. You can fund these wallets through a variety of methods, including direct debit from one account to another, avoiding the need to schedule transfers. Our platform's integration capabilities ensure a seamless payment experience across various geographical locations, facilitating businesses' quick entry into new markets, talent retention, and scalable operations.

Multiple payment options

Nium accommodates a wide range of payout endpoints. Businesses can send payroll through multiple payment options, catering to the diverse preferences of their international workforce. Whether it's disbursing funds to bank accounts, wallets, or cards, Nium's infrastructure supports a variety of payout methods. This flexibility ensures that everyone, regardless of their location or preferred payment method, receives their earnings in the most convenient way possible.

Embracing global payroll - challenges and all

Global business transcends borders, making international payroll not just a necessity but a fundamental cog in the wheel of global commerce. Nium keeps the wheels turning, helping companies navigate the intricacies of global payroll with ease. By providing solutions that tackle foreign exchange management, real-time payments, and a robust financial infrastructure, Nium ensures that businesses can focus on expansion and innovation while we take care of the complexities of international payroll payments.

Download the ebook Payroll Goes Global today: Dive into even more detail about how savvy international businesses can optimize workforce payments.

.png@webp)

.png@webp)

.png@webp)

.png@webp)